In the quiet corners of our lives, there exists an issue that often goes unnoticed until it emerges as a pressing concern. This matter impacts millions of individuals in the United States and worldwide – medical debt.

Imagine a scenario where you receive an unexpected medical bill in the mail, from a service you had a year ago and stemming from a procedure over which you had no control. The figure on that bill can be staggering and the emotional toll it takes is immeasurable. This is the hidden crisis of medical debt collection—often lurking in the shadows, it’s a financial burden that can strike anyone, regardless of their economic status.

Medical debt doesn’t just involve medical bills; it also comes with a myriad of legal intricacies. A legal framework known as medical debt collection rules exists, which renders comprehension of this legal framework crucial.

As we delve deeper into the domain of medical bill collections laws, it becomes evident that the scope of this issue extends beyond laws and regulations; it encompasses ethical considerations. Healthcare institutions and debt collectors bear an ethical and moral responsibility to ensure that their pursuit of payment does not undermine a patient’s health or dignity.

We’ll explore how medical debt law can affect one’s credit and discuss the paths patients can take within the framework of medical collection laws. So, fasten your seatbelts, and let’s navigate this terrain together, where understanding, empathy, and change are the destination.

Can medical bills be sent to collections?

Sending a medical bill to collections is usually a measure of last resort. According to hospital debt collection laws, it’s typically initiated when an outstanding medical bill remains unpaid for an extended period of time, often after three or four months. Your healthcare provider could send the unpaid balance to a collection agency if you fail to make your payments on schedule.

Not that non-payment is the only factor considered while making a choice to use an agency. As per medical debt law, your bill could be sent for collections even if you’re following a payment plan or making partial payments if it doesn’t meet the acceptable payment guidelines set by your healthcare provider.

It’s important to understand that, even while unpaid balances may cause medical bills to be sent to collections, the sheer presence of a medical bill does not automatically initiate this process. Clear communication and a good faith effort on both sides are often preferred before resorting to collections.

But don’t panic; medical bill collection laws and regulations provide consumers a level of protection and enforce when and how a collector attempts to collect a debt from you.

Does medical debt affect credit score?

Medical debt can indeed affect credit, but recent developments in medical bill collections rules and regulations have introduced some positive changes for the consumer in how it impacts credit scores. The CFPB released a report in July 2023 outlining the possible effects of the modifications it had suggested to medical debt credit reporting. According to the report, the modifications could result in a 25-point increase in credit ratings, a decrease in the chance of filing for bankruptcy, and easier access to credit for consumer

With the newly reformed medical collections law, medical debts under $500 that are in collections are now excluded from credit reports. This provides relief for those with relatively small medical debts. In addition, unpaid medical debts that have been paid are being removed from credit reports, which is a positive change for individuals who have resolved their financial obligations. So, unpaid medical debts will only appear on a credit report after 365 days, as opposed to the previous six-month timetable. This extension allows consumers more time to address the debt.

Additional changes have been influenced in part by the No Surprises Act which went into effect in 2022. The Act enhanced consumer protections preventing providers from sending unexpected healthcare bills and requiring good faith estimates to be provided to patients prior to receiving non emergent services.

What are the consumer protections afforded by the Medical Bill Collection Rules?

You have certain rights when it comes to fighting medical debt collection. These rights are rooted in various consumer financial protection laws and regulations, which provide safeguards and avenues for recourse. Here’s how to put your legal protections into practice:

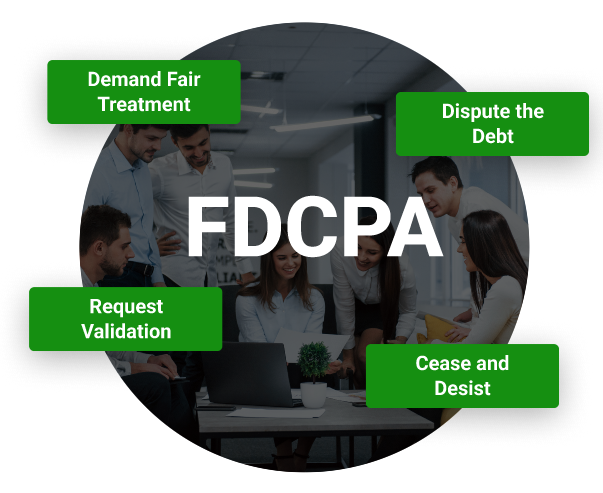

Fair Debt Collection Practices Act (FDCPA):

Under the FDCPA, you can:

Demand Fair Treatment: You can insist on being treated fairly and respectfully by debt collectors. Threats, harassment, deception, coercion, and other abusive tactics are strictly prohibited.

Dispute the Debt: You can dispute the debt within 30 days of receiving a bill from a collection agency if you believe it is incorrect or unjust. Debt collectors must investigate and provide evidence to support the debt’s validity within 30 days of your dispute.

Request Validation: You have the right to request validation of the debt if/when there are doubts about the accuracy or legitimacy of the debt, requesting validation is a crucial step.

Cease and Desist: You can request that debt collectors cease further communication. While this doesn’t eliminate the debt, it can stop harassing calls and letters.

By being aware of their rights and taking proactive steps to exercise them, you can effectively fight within the framework of medical debt collection rules. These medical collections law are designed to protect you from unfair or abusive debt collection practices and provide opportunities for resolution and relief.

Best practices to protect yourself:

-

- Keep detailed records of all interactions with debt collectors, including dates, times, and the content of conversations.

-

- Communicate in writing when disputing a debt or requesting validation, as written correspondence provides a clear record of the exchange.

-

- Regularly review your credit reports to ensure the accuracy of reported information and promptly address any discrepancies.

Hospital Debt Collection Laws: Your Safe Harbor

When faced with the daunting prospect of medical debts, there’s no need to panic. While medical bills can indeed be overwhelming, it’s crucial to remember that if a service was provided, payment is due. Healthcare providers will work with you early-on so the account doesn’t age out and require the assistance of an outside collection agency. Understand your insurance benefits and review your good faith estimates to ensure you are not paying more than what you originally agreed to (not including additional procedures when complications warrant).

At Medical Data Systems, Inc., we understand you did not ask or request medical debt. Our recovery specialists treat every guarantors with courtesy and respect for their healthcare and financial well-being. Our mission is to prioritize your best interests in this complex landscape.

We’re bidding adieu for the time being, but don’t worry—we’ll be back with more useful advice and workable solutions to help you deal with medical debt. You are not alone in this, and there are support networks and medical debt collection laws in place to protect you and help you manage the challenges brought on by medical debt.